2019 Year-End Tax Updates for Financial Planning

Year-end tax planning in 2019 remains as complicated as ever. Notably, we are still coping with the massive changes included in the biggest tax law in decades—the Tax Cuts and Jobs Act (TCJA) of 2017—and pinpointing the optimal strategies. This monumental tax legislation includes a myriad of provisions affecting a wide range of individual and business taxpayers.

For our clients convenience, we have prepared the following 2019 Year-End Tax Updates for Financial Planning Be aware the concepts are intended to provide only a general overview of year-end tax planning. It is recommended you review your personal situation with a tax professional.

Securities Transactions

Frequently, investors engage in securities transactions at year-end to improve their tax situation. This requires a basic understanding of the current tax rules for capital gains and losses.

First, capital gains and losses are used to offset each other. Second, if you show an excess loss for the year, it then offsets up to $3,000 of ordinary income before being carried over to the next year. Third, long-term capital gains from sales of securities owned longer than one year are taxed at a maximum rate of 15% (20% for high-income investors). Conversely, short-term capital gains are taxed at ordinary income rates reaching up to 37% in 2019.

YEAR-END ACTION: Review your investment portfolio. Depending on your situation, you may “harvest” capital losses to offset gains realized earlier in the year or cherry-pick capital gains that will be partially or wholly absorbed by prior losses, including capital loss carryovers.

Be aware of even more favorable tax treatment for certain long-term capital gains. Notably, a 0% rate applies to taxpayers below applicable income levels, such as young children or grandchildren. Furthermore, some taxpayers who ultimately pay ordinary income tax at higher rates due to their investments may qualify for the 0% tax rate on a portion of their long-term capital gains.

Tip: The tax rate structure for long-term capital gains also applies to qualified dividends. These are most dividends paid by U.S. companies or qualified foreign companies.

Installment Sales

Normally, when you sell real estate at a gain, you must pay tax on the full amount of capital gain in the year of the sale.

YEAR-END ACTION: Arrange to sell real estate on the installment basis. If you receive installment payments over two or more tax years, the tax on a gain is paid over the years in which payments are actually received. This tax deferral treatment is automatic for most installment sales other than sales by “dealers” like real estate developers.

The taxable portion of each payment is based on the “gross profit ratio.” Gross profit ratio is determined by dividing the gross profit from the real estate sale by the price.

Not only does the installment sale technique defer some of the tax due on a real estate deal, it will often reduce your overall tax liability if you are a high-income taxpayer. Reason: By spreading out the taxable gain over several years, you may pay tax on a greater portion of gain at the 15% capital gains rate as opposed to the 20% rate.

Tip: If it suits your purpose, you may “elect out” of installment sale treatment when you file your tax return. This means the entire amount of tax is due on the return for the year of the sale. You might do this if 2019 is otherwise a low tax year.

Net Investment Income Tax

In addition to capital gains tax, a special 3.8% tax applies to the lesser of your “net investment income” (NII) or the amount by which your modified adjusted gross income (MAGI) for the year exceeds $200,000 for single filers and $250,000 for joint filers. (Note: These amounts are not indexed for inflation.) The definition of NII includes interest, dividends, capital gains and income from passive activities, but not Social Security benefits, tax-exempt interest and distributions from qualified retirement plans and IRAs.

YEAR-END ACTION: Assess the amount of your NII and your MAGI at the end of the year. When it is possible, you may be able to reduce your NII tax liability in 2019 or avoid it altogether.

For example, you might add municipal bonds (“munis”) to your portfolio. Interest income generated by munis does not count as NII, nor is it included in the calculation of MAGI. Similarly, if you turn a passive activity into an active business, the resulting income may be exempt from the NII tax. These rules are complex, so obtain professional assistance.

Tip: When you add the NII tax to your regular tax plus any applicable state income tax, the overall rate may approach or even exceed 50%. Factor this into your investment decisions.

Required Minimum Distributions

As a general rule, you must receive “required minimum distributions” (RMDs) from qualified retirement plans and IRAs after reaching age 70½. The amount of the distribution is based on IRS life expectancy tables and your account balance at the end of last year.

The “Setting Every Community Up for Retirement Enhancement” (SECURE) Act, the biggest retirement law in the last decade, generally takes effect on January 1, 2020. Among other significant changes, it effectively eliminates “stretch IRAs” allowing noon-spousal beneficiaries to postpone required minimum distributions (RMDs), increases the age for starting RMDs from 70 1/2 to 72, allows individuals over 70 1/2 to contribute to traditional IRAs, provides enhanced credits for businesses that start up a qualified retirement plan and enhances certain employee protections.

YEAR-END ACTION: Arrange to receive RMDs before December 31. Otherwise, you will have to pay a stiff tax penalty equal to 50% of the required amount (less any amount you have received) in addition to your regular tax liability.

Do not procrastinate if you have not arranged RMDs for 2019 yet. It may take some time for your financial institution to accommodate these transactions.

Conversely, if you are still working and do not own 5% or more of the business employing you, you can postpone RMDs from an employer’s qualified plan until you retire. This “still working exception” does not apply to RMDs from IRAs or plans of employers where you do not work.

Tip: RMDs are not treated as NII for purposes of the 3.8% tax. Nevertheless, an RMD may still increase your MAGI used in the NII tax calculation.

Estate and Gift Taxes

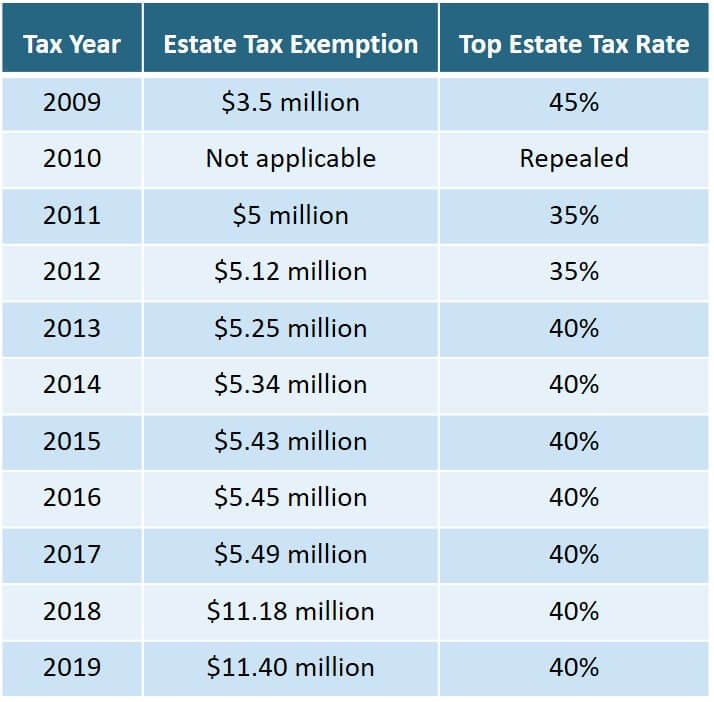

Since the turn of the century, Congress has gradually increased the federal estate tax exemption, while eventually establishing a top estate tax rate of 40%. At one point, the estate tax was repealed—but only for 2010—while the unified estate and gift tax exclusion was severed and then reunified. Finally, the TCJA doubled the exemption from $5 million to $10 million, inflation-indexed to $11.4 million in 2019. The following table shows the progression of the estate tax exemption and top estate tax rate during the last decade.

YEAR-END ACTION: Update your estate plan to reflect existing law. For instance, wills and trusts may be revised to accommodate the rule allowing portability of the estate tax exemption.

YEAR-END ACTION: Update your estate plan to reflect existing law. For instance, wills and trusts may be revised to accommodate the rule allowing portability of the estate tax exemption.

Under the “portability” provision for a married couple, the unused portion of the estate tax exemption of the first spouse to die may be carried over to the estate of the surviving spouse. This tax break is now permanent, so incorporate it into your estate planning decisions.

Tip: With the gift tax exclusion, you can give each recipient, such as a younger family member, up $15,000 in 2019 without paying any federal gift tax. This annual gift tax exclusion is effectively doubled to $30,000 for joint gifts made by a married couple. These gifts reduce the size of your taxable estate.

Miscellaneous

* Contribute up to $19,000 to a 401(k) in 2019 ($25,000 if you are age 50 or older). If you clear the 2019 Social Security wage base of $132,900 and promptly allocate the payroll tax savings to a 401(k), you can increase your deferral without any further reduction in your take-home pay.

* From a tax perspective, it is often beneficial to sell mutual fund shares before the fund declares dividends (the ex-dividend date) and buy shares after the date the fund declares dividends.

* Be wary of the “wash sale” rule. If you sell securities at a loss and reacquire substantially identical securities within 30 days of the sale, the tax loss is disallowed. An easy way to avoid this result is to wait at least 31 days to buy back the same or similar securities.

* Consider a Roth IRA conversion. Although the conversion is subject to current tax, you generally can receive tax-free distributions in retirement, unlike the taxable distributions from a traditional IRA. But note that the TCJA removed the ability to “recharacterize” a Roth conversion back into a traditional IRA for 2018 and thereafter.

* If you are age 70½ or older, transfer IRA funds directly to a charity. Even though the contribution cannot be deducted as a charitable donation on your 2019 tax return, the distribution is not subject to tax and counts as an RMD.

Contact Us

This year-end tax-planning article is based on the prevailing federal tax laws, rules and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

Finally, remember this is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. We would be glad to schedule a meeting with you to assist with all your tax-planning needs. To contact us, please complete the form below!

For information about year-end Individual Tax Planning, please click here.

For information about year-end Business Tax Planning, please click here.