2019 Year-End Tax Updates for Individual Planning

Year-end tax planning in 2019 remains as complicated as ever. Notably, we are still coping with the massive changes included in the biggest tax law in decades—the Tax Cuts and Jobs Act (TCJA) of 2017—and pinpointing the optimal strategies. This monumental tax legislation includes a myriad of provisions affecting a wide range of individual and business taxpayers.

For our clients convenience, we have prepared the following 2019 Year-End Tax Updates for Individuals. Be aware the concepts are intended to provide only a general overview of year-end tax planning. It is recommended you review your personal situation with a tax professional.

Itemized Deductions

Among the most prominent tax changes for individuals, the TCJA essentially doubled the standard deduction while modifying the itemized deduction rules for 2018 through 2025. For 2019, the inflation-indexed standard deduction is $12,200 for single filers and $24,400 for joint filers.

YEAR-END ACTION: With the assistance of your professional tax advisor, figure out if you will be claiming the standard deduction or itemizing deductions in 2019. The results of this analysis will likely dictate your tax planning approach at the end of the year. Some or all of these TCJA provisions on itemized deductions may affect the outcome.

* The deduction for state and local taxes (SALT) is limited to $10,000 annually. This includes any combination of SALT payments for (1) property taxes and (2) income or sales taxes.

* The deduction for mortgage interest expenses is modified, but you can still write off interest on “acquisition debt” (e.g., to purchase your principal residence) within generous limits. Recent legislation also reinacts the deduction for mortgage insurance premiums back to 2018.

* The deduction for casualty and theft losses is eliminated (except for disaster-area losses).

* The deduction for miscellaneous expenses is eliminated, but certain reimbursements made by employers may be tax-free to employees.

* The threshold for deducting medical and dental expenses, which was temporarily lowered to 7.5% of adjusted gross income (AGI), will stay at this level thanks to new legislation enacted in December 2019.

Tip: Depending on your situation, you may want to accelerate deductible expenses into the current year to offset your 2019 tax liability. However, if you do not expect to itemize deductions in 2019, you might as well postpone these expenses to 2020 or beyond.

Charitable Donations

Generally, itemizers can deduct amounts donated to qualified charitable organizations, as long as substantiation requirements are met. Note that the TCJA increased the annual deduction limit for monetary contributions from 50% of AGI to 60% for 2018 through 2025. Any excess is carried over for up to five years.

YEAR-END ACTION: Absent extenuating circumstances, try to “bunch” charitable donations in the year they will do you the most tax good. For instance, if you will be itemizing in 2019, boost your gift giving at the end of the year. Conversely, if you are claiming the standard deduction this year, you may decide to postpone contributions to 2020.

For donations of appreciated property that you have owned longer than one year, you can generally deduct an amount equal to the property’s fair market value (FMV). Otherwise, the deduction is typically limited to your initial cost. Also, other special rules may apply to gifts of property. Notably, the annual deduction for property donations generally cannot exceed 30% of AGI.

If you intend to donate securities to a charity, you might choose securities that you have held longer than one year and have appreciated substantially in value. Conversely, it may be preferable to keep securities you have owned less than a year.

Tip: If you donate to a charity by credit card late in the year—for example, if you are making an online contribution—you can write off the donation on your 2019 return, even if you do not actually pay the credit card charge until 2020.

Alternative Minimum Tax

Briefly stated, the alternative minimum tax (AMT) is a complex calculation made parallel to your regular tax calculation. It features several technical adjustments, inclusion of “tax preference items” and subtraction of an exemption amount (subject to a phase-out based on your income). After comparing AMT liability to regular tax liability, you effectively pay the higher of the two.

YEAR-END ACTION: Have your AMT status assessed. Depending on the results, you may then shift certain income items to 2020 to reduce AMT liability for 2019. For instance, you might postpone the exercise of incentive stock options (ISOs) that count as tax preference items.

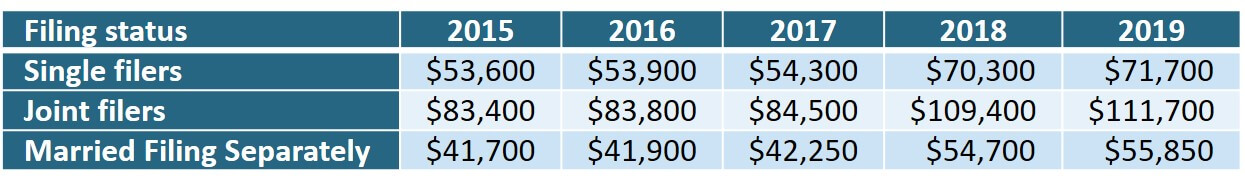

Thanks to the TCJA, the AMT is now affecting fewer taxpayers. Notably, the TCJA substantially increased the AMT exemption amounts (and the thresholds for the phase-out), unlike the minor annual “patches” authorized by Congress in the recent past. The chart below illustrates the exemptions for the last five years and includes a dramatic jump for 2018-19.

Tip: The two AMT rates for single and joint filers for 2019 are 26% on AMT income up to $194,800 ($97,400 if married and filing separately) and 28% on AMT income above this threshold. Note that the top AMT rate is still lower than the top ordinary income tax rate of 37%.

Education Tax Breaks

The tax law provides tax benefits to parents of children in college, within certain limits. These tax breaks, including a choice involving two higher education credits, have been preserved by the TCJA.

YEAR-END ACTION: When appropriate, pay qualified expenses for next semester by the end of the year. Generally, the costs will be eligible for a credit in 2019, even though the semester does not begin until 2020. Therefore, you may be able to increase your current credit amount.

Typically, you must choose between the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). The maximum AOTC of $2,500 is available for qualified expenses of each student, while the maximum $2,000 LLC is claimed on a per-family basis. Thus, the AOTC is usually preferable. Both credits are phased out based on modified adjusted gross income (MAGI).

The tuition and fees deduction was reinstated at the end of 2019, retroactive back to 2018. If an amended tax return is in order please contact us.

The TCJA also allows you to use Section 529 plan funds to pay for up to $10,000 of K-12 tuition expenses tax-free. Previously, qualified expenses only covered post-secondary schools. The SECURE Act passed in December 2019 also now allows Section 529 plan funds to be used to payback up to $10,000 in student loans.

Estimated Tax Payments

The IRS requires you to pay federal income tax through any combination of quarterly installments and tax withholding. Otherwise, it may impose an “estimated tax” penalty.

YEAR-END ACTION: No estimated tax penalty is assessed if you meet one of these three “safe harbor” exceptions under the tax law.

1. Your annual payments equal at least 90% of your current liability;

2. Your annual payments equal at least 100% of the prior year’s tax liability (110% if your AGI for the prior year exceeded $150,000); or

3. You make installment payments under an “annualized income” method. This method may be available to taxpayers who receive most of their income during the holiday season.

Tip: Due to the complexity of the TCJA, the IRS lowered the 90% safe harbor rule to 80% for the 2018 tax year. There has been no word yet on any reduction for 2019.

Miscellaneous

* Bunch non-emergency medical expenses in the year in which you have the best chance of clearing the 7.5%-of-AGI threshold. For instance, you may schedule a physical exam or dental cleaning for 2019 or postpone those expenses to 2020 if it better suits your purposes.

* Make home improvements that qualify for mortgage interest deductions as acquisition debt. This includes loans to substantially improve your principal residence or one other home.

* Transfer income-producing property to family members in lower tax brackets. However, the “kiddie tax” generally applies to unearned income above $2,200 received in 2019 by a dependent child under age 18 or full-time student under age 24. Under the TCJA, the kiddie tax is based on the tax rates for estates and trusts, which will often produce a higher tax than it would have previously. Recent legislation reverts the kiddie tax back to the parents’ tax rate, but not until 2020. You can elect to use the parents’ rate for 2018 and 2019. Contact us for more information.

* Consider the tax impact of a divorce or separation. The TCJA repealed the deduction for alimony expenses for payers, and the corresponding inclusion in income for recipients, for divorce and separation agreements executed after 2018. Note that deductions may still be available for pre-2019 agreements that are modified after 2018.

* If you own property that was damaged in a federal disaster area in 2019, you may qualify for fast casualty loss relief by filing an amended 2018 return. The TCJA suspended the deduction for casualty losses for 2018 through 2025, but retained a current deduction for disaster-area losses.

* Starting in 2019, the penalty for not having health insurance has also been eliminated.

Contact Us

This year-end tax-planning article is based on the prevailing federal tax laws, rules and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

Finally, remember this is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. We would be glad to schedule a meeting with you to assist with all your tax-planning needs. To contact us, please complete the form below!

For information about year-end Business Tax Planning, please click here.

For information about year-end Financial Tax Planning, please click here.