2019 Year-End Tax Updates for Business Planning

Year-end tax planning in 2019 remains as complicated as ever. Notably, we are still coping with the massive changes included in the biggest tax law in decades—the Tax Cuts and Jobs Act (TCJA) of 2017—and pinpointing the optimal strategies. This monumental tax legislation includes a myriad of provisions affecting a wide range of individual and business taxpayers.

For our clients convenience, we have prepared the following 2019 Year-End Tax Updates for Businesses. Be aware the concepts are intended to provide only a general overview of year-end tax planning. It is recommended you review your personal situation with a tax professional.

Depreciation-Related Deductions

Under the TCJA, a business may benefit from a combination of three depreciation-based tax breaks: (1) the Section 179 deduction, (2) “bonus” depreciation and (3) regular depreciation.

YEAR-END ACTION: Acquire property and make sure it is placed in service before the end of the year. Typically, a small business can then write off most, if not all, of the cost in 2019.

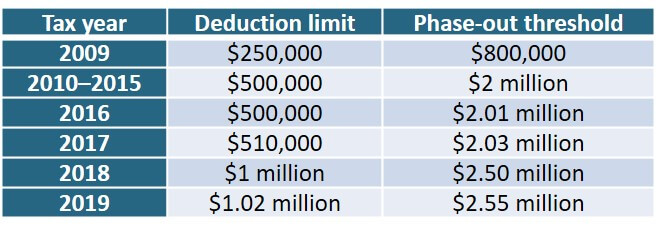

1. Section 179 deductions: This tax code section allows you to “expense” (i.e., currently deduct) the cost of qualified property placed in service during the year. The maximum annual deduction is phased out on a dollar-for-dollar basis above a specified threshold.

The maximum Section 179 allowance has been raised gradually over the last decade, but the TCJA gave it a massive boost, beginning in 2018, as shown below.

However, note that the Section 179 deduction cannot exceed the taxable income from all your business activities this year. This could limit your deduction for 2019.

2. Bonus depreciation: The TCJA doubled the previous 50% first-year bonus depreciation deduction to 100% for property placed in service after September 27, 2017. It also expanded the definition of qualified property to include used, not just new, property.

Note that the TCJA gradually phases out bonus depreciation after 2022. This tax break is scheduled to disappear completely after 2026.

3. Regular depreciation: Finally, if there is any remaining acquisition cost, the balance may be deducted over time under the Modified Accelerated Cost Recovery System (MACRS).

Tip: A MACRS depreciation deduction may be reduced if the cost of business assets placed in service during the last quarter of 2019 (October 1 through December 31) exceeds 40% of the cost of all assets placed in service during the year (not counting real estate).

Travel Expenses

Although the TCJA repealed the deduction for entertainment expenses beginning in 2018, you can still deduct expenses for travel and meal expenses while you are away from home on business, subject to certain limits. The primary purpose of the trip must be business-related.

YEAR-END ACTION: Schedule business trips for the end of 2019. If you meet the strict substantiation requirements, you may deduct 100% of your travel costs and 50% of meal costs for amounts paid or incurred this year.

If you travel by car, you may be able to deduct your actual expenses, including a depreciation allowance, or opt for the standard mileage deduction. The standard mileage rate for 2019 is 58 cents per business mile (plus tolls and parking fees). Annual depreciation deductions for “luxury cars” are limited, but the TCJA generally enhanced those deductions for vehicles placed in service in 2018 and thereafter.

Tip: The IRS recently issued a ruling that explains when food and beverage costs are deductible when those costs are stated separately from entertainment on invoices or receipts.

QBI Deductions

The TCJA authorized a deduction of up to 20% of the “qualified business income” (QBI) earned by a qualified taxpayer. This deduction may be claimed by owners of pass-through entities—partnerships, S corporations and limited liability companies (LLCs)—as well as sole proprietors.

YEAR-END ACTION: The QBI deduction is reduced for some taxpayers based on the amount of their income. Depending on your situation, you may accelerate or defer income at the end of the year, according to the figures.

First, however, it must be determined if you are in a “specified service trade or business” (SSTB). This includes most personal service providers. Then three key rules apply.

1. If you are a single filer with income in 2019 below $160,725 or a joint filer below $321,400, you are entitled to the full 20% deduction.

2. If you are a single filer with income in 2019 above $210,700 or a joint filer above $421,400, your deduction is completely eliminated if you are in an SSTB. For non-SSTB taxpayers, the deduction is reduced, possibly down to zero.

3. If your income falls between the thresholds stated above, your QBI deduction is reduced, regardless of whether you are in an SSTB or not.

Tip: Other rules and limits may apply, including new guidelines for real estate activities. Consult with your tax advisor for more details about your situation.

Business Repairs

While expenses for business repairs are currently deductible, the cost of improvements to business property must be written off over time. The IRS recently issued regulations that clarify the distinctions between repairs and improvements.

YEAR-END ACTION: When appropriate, complete minor repairs before the end of the year. The deductions can offset taxable business income in 2019.

As, a rule of thumb, a repair keeps property in efficient operating condition while an improvement prolongs the life of the property, enhances its value or adapts it for a different use. For example, fixing a broken window is a repair, but adding a new building wing is an improvement.

Tip: A safe harbor rule in the regulations allows a business to currently deduct costs of $2,500 or less, or $5,000 or less for a business with an “applicable financial statement” (AFS).

Business Interest

Prior to 2018, business interest was fully deductible. But now the TCJA generally limits the deduction for business interest to 30% of adjusted taxable income (ATI).

YEAR-END ACTION: Determine if you qualify for a special exception. The limit does not apply to a business with average gross receipts of $25 million or less for the three prior years.

For these purposes, ATI is defined as your business income without regard to any income, deduction, gain or loss not properly allocable to a business; business interest income and expense; net operating losses (NOLs); the 20% QBI deduction; and, for tax years beginning before 2022, depreciation, amortization or depletion.

Tip: If the new business interest limit applies, you can carry forward the excess indefinitely until it is exhausted.

Miscellaneous

* Stock up on routine business supplies before the end of the year. Usually, your company can deduct the costs of the supplies in 2019, even if all of them are not used until 2020.

* If you buy a heavy-duty SUV or van for business, you may claim a first-year Section 179 deduction of up to $25,000. The “luxury car” limits do not apply to certain heavy-duty vehicles.

* If you pay year-end bonuses to employees in 2019, the bonuses are generally deductible by your company and taxable to the employees in 2019. A calendar-year company operating on the accrual basis may be able to deduct bonuses paid as late as March 16, 2020 on its 2019 return.

* Gather proof needed to claim a bad business debt deduction. Generally, the deduction is available in the year the debt becomes worthless, so step up collection activities and keep records.

* Hire disadvantaged workers eligible for the Work Opportunity Tax Credit (WOTC). The WOTC, which is generally a maximum of $2,400 per worker, is scheduled to expire after 2019.

* Get a start-up venture up and running. The tax law permits a small-business owner to claim a first-year deduction of up to $5,000 for qualified start-up costs. Any remainder must be amortized over 180 months. However, the $5,000 write-off is phased out for costs above $50,000.

* A business may qualify for an up-to-25% credit for paid family and medical leaves of up to 12 weeks. This credit, which only applies to wages paid to employees earning no more than $72,000 annually, is currently scheduled to expire after 2019.

As part of an appropriations measure, Congress passed a flurry of new tax legislation at the end of 2019. These new rules may have an impact on 2019 tax returns to be filed in 2020.

The “Taxpayer Certainty and Disaster Tax Relief Act of 2019” extends through 2020 several tax breaks for businesses that include the family and medical leave credit and the Work Opportunity Tax Credit (WOTC) for hiring workers from disadvantaged groups, as well as various industry-specific tax incentives.

Contact Us

This year-end tax-planning article is based on the prevailing federal tax laws, rules and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

Finally, remember this is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. We would be glad to schedule a meeting with you to assist with all your tax-planning needs. To contact us, please complete the form below!

For information about year-end Individual Tax Planning, please click here.

For information about year-end Financial Tax Planning, please click here.