2021 Year End Business Tax Planning

This is the time to assess your tax outlook for 2021. By developing a comprehensive year-end plan, you can maximize the tax breaks currently on the books and avoid potential pitfalls. Be aware that the concepts discussed in this article are intended to provide only a general overview of year-end tax planning. It is recommended that you review your personal situation with a tax professional.

Depreciation-Related Deductions

At year-end, a business may secure one or more of three depreciation-related tax breaks: (1) the Section 179 deduction; (2) first-year “bonus” depreciation; and (3) regular depreciation.

TAX TACTIC: Make sure that qualified property is placed in service before the end of the year. If your business does not start using the property, it does not qualify for these tax breaks.

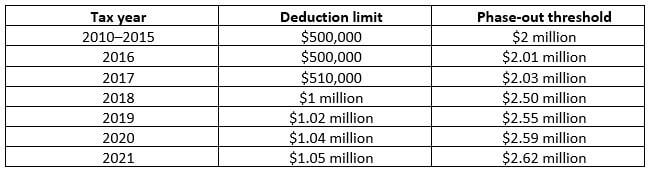

- Section 179 deductions: Under this section of the tax code, a business may “expense” (i.e., currently deduct) the cost of qualified property placed in service anytime during the year. The maximum annual deduction is phased out on a dollar-for-dollar basis above a specified threshold.

The maximum Section 179 allowance has increased gradually since it was doubled to $500,000 in 2010. As shown below, the TCJA effectively doubled the amount again in 2018.

However, be aware that the Section 179 deduction cannot exceed the taxable income from all your business activities this year. This could limit your deduction for 2021.

2. First-year bonus depreciation: The TCJA doubled the 50% first-year bonus depreciation deduction to 100% for property placed in service after September 27, 2017 and expanded the definition of qualified property to include used, not just new, property. However, the TCJA gradually phases out bonus depreciation after 2022.

3. Regular depreciation: If any remaining acquisition cost remains, the balance may be deducted over time under the Modified Accelerated Cost Recovery System (MACRS).

Tip: The CARES Act fixed a glitch in the TCJA relating to “qualified improvement property” (QIP). Thanks to the change, QIP is eligible for bonus depreciation, retroactive to 2018. Therefore, your business may choose to file an amended return for a prior year.

Employee Retention Credit

Many business operations have been disrupted by the COVID-19 pandemic. At least recent legislation provides tax incentives for keeping workers on the books during these uncertain times.

TAX TACTIC: When it makes sense, retain your top workers as long as you can. The CARES Act authorized an employee retention credit (ERC) to offset some of the cost.

Under the CARES Act, the ERC was equal to 50% of the first $10,000 of qualified wages per quarter, for a maximum credit of $5,000 per worker. The CAA extended availability of the credit into 2021 with certain modifications, including a maximum ERC of $14,000 per worker per year. The ARPA authorized a maximum credit of $28,000 per worker for 2021, but the passage of the bipartisan infrastructure bill reduced that to $21,000 per worker by eliminating ERC for the fourth quarter of 2021.

In addition, ARPA allows businesses that started up after February 15, 2020 and have an average of $1 million or less in gross receipts to claim a credit of up to $50,000 per quarter.

More information about ERC may be found on our webpage HERE.

Business Meals

Previously, a business could deduct 50% of the cost of its qualified business entertainment expenses. However, the TCJA permanently eliminated the deduction for entertainment expenses, including strictly social meals preceding or following a “substantial business deduction.”

TAX TACTIC: Stay the course. Current law still allows deductions for certain business meals if you have the records needed to support your claims. Plus, your business may benefit from an enhanced deduction in 2021.

For starters, a business can deduct meal expenses of employees traveling away from home on business. In addition, the cost of food and beverages associated with entertainment such as sporting events and concerts may be deductible if the food and beverages are invoiced separately. The IRS has issued detailed regulations relating to these deductions.

Note that the cost of the food and beverages cannot be artificially inflated. Obtain the invoices from the appropriate venues.

Tip: ARPA doubles the usual 50% deduction to 100% of the cost of food and beverages provided by restaurants in 2021 and 2022. Thus, your business may write off the entire cost of some meals this year.

Work Opportunity Tax Credit

If your business becomes busier than usual during the holiday season, it may add to the existing staff. Consider all the relevant factors, including tax incentives, in your hiring decisions.

TAX TACTIC: All other things being equal, you may hire workers eligible for the Work Opportunity Tax Credit (WOTC). The credit is available if a worker falls into a “target” group.

Generally, the WOTC equals 40% of the first-year wages of up to $6,000 per employee, for a maximum of $2,400. For certain qualified veterans, the credit may be claimed for up to $24,000 of wages, for a $9,600 maximum. There is no limit on the number of credits per business.

Tip: The WOTC has expired—and then been reinstated—multiple times in the past, but the CAA extended it for five years through 2025.

Business Start-up Expenses

The tax law allows a small business owner to claim a first-year deduction of up to $5,000 for qualified start-up costs. Any remaining expenses must be amortized over 180 months. However, the $5,000 write-off is phased out for start-up costs exceeding $50,000.

TAX TACTIC: Open for business before the end of the year. Typically, this means you must begin offering goods or services. Otherwise, you cannot claim the current $5,000 deduction.

Generally, start-up costs are those that would be deductible as business expenses, such as:

- An analysis of potential markets, products, labor supply, transportation facilities, etc.

- Advertisements for the opening of the business.

- Salaries and wages for employees who are being trained and those instructing them.

- Travel costs to secure prospective distributors, suppliers, customers or clients.

- Salaries and fees for executives and consultants or similar professional services.

Tip: If it suits your purposes, you can elect to have all business start-up costs amortized over 180 months. This may be preferable for an entrepreneur expecting a low tax liability in 2021.

Miscellaneous

- Stock up on routine supplies (especially if they are in high demand). If you buy the supplies in 2021, they are deductible in 2021, even if you do not use them until 2022.

- Under the CARES Act, a business could defer 50% of certain payroll taxes due in 2020. Half of the deferred amount is due at the end of 2021, so meet this obligation if it applies.

- Maximize the qualified business interest (QBI) deduction for pass-through entities and self-employed individuals. Note that special rules apply if you are in a “specified service trade or business” (SSTB).

- If you pay year-end bonuses to employees in 2021, the bonuses are generally deductible by your company and taxable to the employees in 2021. A calendar-year company operating on the accrual basis may be able to deduct bonuses paid as late as March 15, 2022, on its 2021 return.

- Generally, repairs are currently deductible, while capital improvements must be depreciated over time. Therefore, make minor repairs before 2022 to increase your 2021 deduction.

- Have your C corporation make monetary donations to charity. ARPA extends a 2020 increase in the annual deduction limit from 10% of taxable income to 25% for 2021.

- Keep records of collection efforts (e.g., phone calls, emails and dunning letters) to prove debts are worthless. This may allow you to claim a bad debt deduction.

Conclusion

This year-end tax-planning article is based on the prevailing federal tax laws, rules and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

You may be interested in the other year-end articles:

- Click here for the 2021 Year-End Individual Tax Planning article

- Click here for the 2021 Year-End Financial Tax Planning article

Finally, remember that this article is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. We would be glad to schedule a meeting with you to assist with all your tax-planning needs.