2020 Year End Business Tax Planning

This is the time to paint your overall tax picture for 2020. By developing a year-end plan, you can maximize the tax breaks currently on the books and avoid potential pitfalls. Be aware that the concepts discussed in this article are intended to provide only a general overview of year-end tax planning. It is recommended that you review your personal situation with a tax professional.

Depreciation-Related Deductions

Under current law, a business may benefit from a combination of three depreciation-based tax breaks: (1) The Section 179 deduction, (2) “bonus” depreciation and (3) regular depreciation.

YEAR-END MOVE: Place qualified property in service before the end of the year. Typically, a small business can write off most, if not all, of the cost in 2020 as shown below.

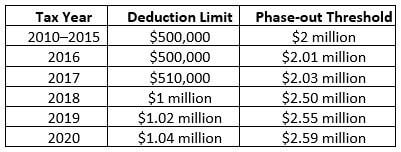

1. Section 179 deductions: This tax code section allows you to “expense” (i.e., currently deduct) the cost of qualified property placed in service anytime during the year. The maximum annual deduction is phased out on a dollar-for-dollar basis above a specified threshold.

The maximum Section 179 allowance has been gradually raised over the last decade since it was doubled to $500,000 in 2010. As shown below, the TCJA increased the amount again in 2018.

However, be aware that the Section 179 deduction cannot exceed the taxable income from all your business activities this year. This could limit your deduction for 2020.

2. Bonus depreciation: The TCJA doubled the 50% first-year bonus depreciation deduction to 100% for property placed in service after September 27, 2017 and expanded the definition of qualified property to include used, not just new, property. However, the TCJA gradually phases out bonus depreciation after 2022.

3. Regular depreciation: Finally, if there is any remaining acquisition cost, the balance may be deducted over time under the Modified Accelerated Cost Recovery System (MACRS).

Note: The CARES Act fixes a glitch in the TCJA relating to “qualified improvement property” (QIP). Under the new law, QIP is eligible for bonus depreciation, retroactive to 2018. Therefore, your business may choose to file an amended return for the appropriate tax year.

Payroll Tax Deferral

Normally, employers must deposit payroll taxes with the IRS under a schedule based on the size of the company revenue. Most small businesses are on a monthly schedule.

YEAR-END MOVE: Take advantage of a payroll tax deferral break. Under the CARES Act, an employer can defer payment of the 6.2% Social Security tax portion of payroll taxes for the period spanning March 27, 2020, through December 31, 2020.

Half of the deferred amount is due at the end of 2021. The employer must pay the other half by the end of 2022. If you choose this approach, make sure you will have the funds needed to meet your company’s obligations in the future.

Note: Don’t confuse the payroll tax deferral with the “payroll tax holiday” for employees created by an executive order in August. The payroll tax deferral discussed above refers to a separate provision in the CARES Act applying to employers.

Business Interest

Prior to 2018, business interest was fully deductible. But the TCJA generally limited the deduction for business interest to 30% of adjusted taxable income (ATI). Now the CARES Act raises the deduction to 50% of ATI, but only for 2019 and 2020.

YEAR-END MOVE: Determine if you qualify for a special exception. The 50%-of-ATI limit does not apply to a business with average gross receipts of $25 million (indexed for inflation) or less for the three prior years. The threshold for 2020 is $26 million.

For these purposes, ATI is defined as your business income without regard to any income, deduction, gain or loss not properly allocable to a business; business interest income and expense; net operating losses (NOLs); the 20% qualified business income (QBI) deduction; and, for tax years beginning before 2022, depreciation, amortization or depletion.

Note: If the business interest limit applies, you can carry forward the excess indefinitely until it is exhausted.

Employee Retention Credit

Many small businesses have been unable to continue regular operations during the COVID-19 pandemic. Frequently, they are facing difficult decisions concerning employment of workers.

YEAR-END MOVE: Keep employees on the books, if you can, through the end of 2020. The CARES Act authorizes an employee retention credit (ERC) to offset some of the cost.

The ERC equals 50% of the qualified wages an employer pays to employees after March 12, 2020 and before January 1, 2021. For these purposes, “qualified wages” are limited to the first $10,000 of wages paid to each worker during this time period.

Your business qualifies for the credit if it fully or partially suspended operation during any calendar quarter in 2020 due to government orders relating to the COVID-19 outbreak or if it experienced a significant decline in gross receipts (i.e., gross receipts equal to less than 50% of the gross receipts for the same calendar quarter in 2019).

Note: The Families First Coronavirus Response Act (FFCRA), which followed soon after the CARES Act, also provides a tax credit to certain small businesses that have provided emergency paid leave due to the COVID-19 pandemic. The FFCRA provision initially offsets the Social Security tax component of payroll tax. Any excess credit is refundable.

Bad Debt Deduction

During this turbulent year, many small businesses are struggling to stay afloat, resulting in large numbers of outstanding receivables and collectibles.

YEAR-END MOVE: Increase your collection activities now. For instance, you may issue a series of dunning letters to debtors asking for payment. Then, if you are still unable to collect the unpaid amount, you can generally write off the debt as a business bad debt in 2020.

Generally, business bad debts are claimed in the year they become worthless. To qualify as a business bad debt, a loan or advance must have been created or acquired in connection with your business operation and result in a loss to the business entity if it cannot be repaid.

Note: Keep detailed records of all your collection activities—including letters, telephone calls, e-mails and efforts of collection agencies—in your files. This documentation can help support your position claiming worthlessness of the debt if the IRS ever challenges the bad debt deduction.

Miscellaneous

* Maximize the QBI deduction that is available for pass-through entities and self-employed individuals. Be aware you must observe special rules if you’re in a “specified service trade or business” (SSTB).

* If you buy a heavy-duty SUV or van for business, you may claim a first-year Section 179 deduction of up to $25,000. The “luxury car” limits do not apply to certain heavy-duty vehicles.

* If you pay year-end bonuses to employees in 2020, the bonuses are generally deductible by your company and taxable to the employees in 2020. A calendar-year company operating on the accrual basis may be able to deduct bonuses paid as late as March 15, 2021, on its 2020 return.

* Generally, repairs are currently deductible, while capital improvements must be depreciated over time. Therefore, make minor repairs before 2021 to increase your 2020 deduction.

* A C corporation can use cash accounting only if their gross receipts were under $26 million (up from $5 million).

* Hire disadvantaged workers eligible for the Work Opportunity Tax Credit (WOTC). The WOTC, which is generally a maximum of $2,400 per worker, is scheduled to expire after 2020.

* Get a new business up-and-running to qualify for a maximum first-year deduction of $5,000 in start-up costs. Any remainder is amortized over 180 months.

* An employer can claim a refundable credit for certain family and medical leaves provided to employees. The credit is currently scheduled to expire after 2020.

* Investigate Paycheck Protection Program (PPP) forgiveness. Under the CARES Act, PPP loans may be fully or partially forgiven without tax being imposed. Despite recent guidance, this remains a complex procedure, so consult with your professional tax advisor about the details.

Conclusion

This year-end tax-planning article is based on the prevailing federal tax laws, rules and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

You may be interested in the other year-end articles:

- Click here for the 2020 Year-End Individual Tax Planning article

- Click here for the 2020 Year-End Financial Tax Planning article

Finally, remember that this article is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. We would be glad to schedule a meeting with you to assist with all your tax-planning needs.