How Might the New Tax Reform Law Affect Families?

Now that the bill has passed, everyone wants to know how it will affect them. Here’s a comparison of how tax results for a typical family of four might be affected by the tax law changes, which generally are effective for tax years beginning after December 31, 2017.

Taxes Due in 2017

Meet the Smiths. They’re a family with two married parents and 18-year-old twins. Their adjusted gross income (AGI) for 2017 is $200,000. And they qualify for the following itemized deductions:

- State income and property taxes ($19,500),

- Mortgage interest ($25,000), and

- Charitable contributions ($500).

For 2017, because the couple has $45,000 in itemized deductions vs. a standard deduction of only $12,700, it makes sense for the Smiths to itemize. In addition, they’re eligible for a $4,050 exemption for each member of the family, which reduces their AGI by a total of $16,200. So, their taxable income for 2017 is $138,800 ($200,000 – $45,000 – $16,200). They don’t qualify for the child tax credit in 2017, because their children are not under age 17. (Even if the kids were younger, the Smith’s AGI is too high to qualify for the credit for 2017.)

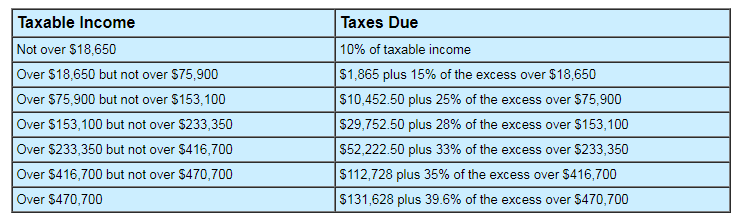

For 2017, the tax brackets for a married couple that files jointly are:

For 2017, the Smiths will owe $26,177.50 in federal income taxes ($10,452.50 + 25% x ($138,800 – $75,900)). That equates to an effective tax rate of 18.9% of taxable income.

Taxes Due in 2018

For simplicity, let’s assume the family’s income and deductions stay the same in 2018. So, again, they have AGI of $200,000 for 2018. But the rules regarding itemized deductions have changed under the new tax reform law. They’re still eligible to deduct charitable contributions and mortgage interest, but their deduction for state property and income tax (combined) is limited to only $10,000. So, the couple’s itemized deductions total $35,500 for 2018.

Under the new law, the standard deduction increases significantly to $24,000 for a married couple. But, for the Smiths, their itemized deductions are still higher than the standard deduction, so it makes sense for them to itemize again in 2018.

The personal and dependency exemptions were suspended through 2025 under the new tax law. The TCJA increases the child credit to $2,000 and the AGI phaseout threshold to $400,000. But the Smiths’ two children, who are over age 17, don’t qualify for the child tax credit. (If their children were under 17, the Smiths would be eligible for $4,000 in child tax credits for 2018.) However, for both of their kids, the family qualifies for the new $500 credit for each dependent who isn’t a qualified child. So the Smiths are eligible for $1,000 in dependent tax credits.

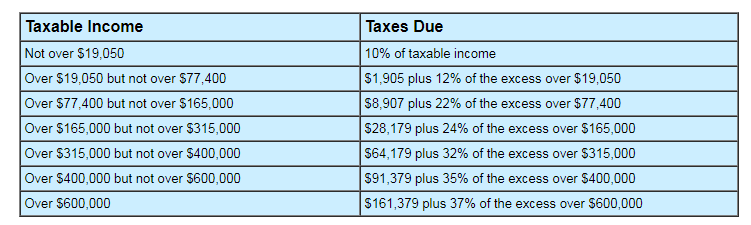

The Smith’s taxable income for 2018 is $164,500 ($200,000 – $35,500). For 2018, the tax brackets for a married couple that files jointly are:

So, for 2018, the Smiths will owe $27,069 in federal income taxes ($8,907 + 22% x ($164,500-$77,400) – $1,000 in dependent tax credits). That equates to an effective tax rate of 16.5% of taxable income.

Bottom Line

As this hypothetical example shows, the TCJA won’t cut taxes for everyone. Here, the Smiths would end up owing an extra $891.50 in taxes for 2018 under the new law, compared to what they will owe for 2017 under the old law. Even though their effective tax rate is reduced, the new law eliminates or limits some key tax breaks for this family and results in a higher tax bill.

Specifically, their state tax deduction was limited to only $10,000 for 2018, and their personal and dependency exemptions were eliminated for 2018.

How would the situation differ if the Smiths’ children were under 17? In that case, the couple’s tax bill would have been reduced by $4,000 in child tax credits, and they would be better off under the new law. That is, their 2018 tax liability would be $24,069 — $2,108.50 less than they will owe for 2017.

Important note: As this example shows, a tax credit (like the child tax credit or the new dependent tax credit) will always provide greater tax savings than a deduction (like the dependency exemption), because credits reduce taxes dollar for dollar. A deduction reduces only the amount of income that’s subject to tax.

Contact Your Tax Pro

Each taxpayer’s situation is unique. Discuss the pros and cons of the new tax law with your tax advisor to determine how the law will affect you and identify tax planning strategies to help lower your taxes in 2018 and beyond. For more information, contact us today!

Copyright 2017